Retirement Matters

February 2024

|

| Marjorie Swick, Personnel Officer from the Department of Licensing and Regulation, the first state employee to sign an enrollment form, with Plan Administrator Duane Marlan (1975). |

|

| January 2025 Photo of Duane Marlan, Mary Pollock, and Joanne Bump, all SERA members, sharing stories about the creation of the DC |

50th Anniversary of State of Michigan, Deferred Compensation Plan (DC) — You may have heard the phrase that — “We stand on the shoulders of those that came before us.” This is never so true as today, as we approach the State of Michiganís 50th anniversary of the DC. SERA was made aware of this 50th anniversary through an interview with Duane Marlan, a Past President of SERA, serving after retiring in 1998. This DC golden anniversary is marked by Marjorie Swick, the first State employee to sign an enrollment form on April 17, 1975. The discussion below provides some history of the DC.

The Michigan tax-deferred savings plan began even before federal law allowed such savings investment plans. Now we know them as the 457 and 401k plans. The Michigan versions of those plans have been revised and enhanced over the years.

State employees quickly saw the value of accumulating savings without paying income taxes until withdrawn during retirement. Allowing tax deferral plans was based on the premise that the DC avoided “constructive receipt” of the savings because the money was deposited in the Stateís common cash fund and the employee had no control over the money. The DC became fully operational in early 1975 and by that year-end 3,370 employees had enrolled. DC payroll deductions more than doubled over a seven-year period based on fiscal year-end data from 5,887 in 1976 to 13,800 in 1982.

IRS Opposed Tax-deferred Savings Accounts — In 1978, the Internal Revenue Service (IRS) said that taxpayers were taking advantage of the tax-deferrals and issued a proposed ruling to remove the primary tax advantage of DCs. Fortunately, Congress passed the Federal Tax Reform Act of 1978, which preserved the plan's tax advantages. But this didnít just happen without testimony defending Michiganís DC before Congress. Along with the Michigan Secretary of State and Attorney General, Duane Marlan spoke before the Senate Finance Committee and House Ways and Means Committee. Making a personal appeal, he testified that just because the IRS doesnít like how some taxpayers are misusing the system, donít take this away from a State employee in Newberry, Michigan.

Selected Law Changes — The State of Michigan 457 plan became law in 1978 within the DC Plan. In 1985, the State of Michigan adopted a 401k plan, originally for Michigan State employees, in the DC plan. Other State of Michigan retirement systems were added over time. In 1997, the 401k Plan was amended to implement a Defined Contribution Retirement Fund

Back in the 1970s, Duane Marlan was the Director of Employee Benefits and credited with the development of the DC Plan. He graduated with a bachelorís degree in 1958 and a masterís degree in 1962 from Michigan State University. His career started out at State Farm Insurance, selling insurance and managing agents, while acquiring insurance and securities licenses, prerequisites for the State job. Duane became the Director of the Employee Benefits Division, with his 99 percent score on his Civil Service test, and insurance work experience. His State salary for a 15 level was just $17,900 back in the early 1970s, below the pay level for insurance managers back then. He served in a leadership role at national conferences on DCs, serving as President of the National Association of State Deferred Compensation Administrators. He invited the IRS to their meetings to get their guidance.

Closing the DB Plan — The State of Michigan closed the Defined Benefit (DB) pension plan for State employees hired on or after March 31,1997. As a result, new hires could enroll in the existing DC which was morphed into a Defined Contribution Plan. The loss of the pension was bad enough, but could have been even worse for retirees. This option offered State employees a softer landing place with a plan already well developed. Even so, most DC plan employees are not saving enough to pay for a comfortable retirement.

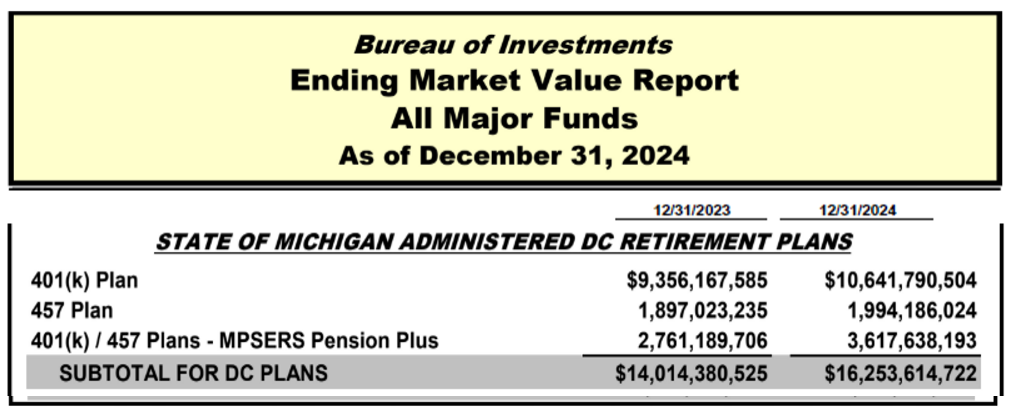

Fast Forward to Today — The value of employee contributions and investments earnings has grown substantially over this 50-year period. The Defined Contribution fund balance includes all the 457 and 401k plans for the all State retirement systems, including State employees. The DC plan started out with one employeeís payroll contribution in 1975 and has grown into a $16.3 billion fund by 2024, with the professional management of the Michigan Department of Treasury, Bureau of Investments.

According to the “Ending Market Value Report” chart in the Treasury's presentation to the SERA Lansing Chapter this February, the total Defined Contribution fund balance rose from $14.0 billion in calendar year (CY) 2023 to $16.3 billion in CY 2024 (rounded), an increase of over 15.9 percent. This success story is having a positive impact on the average retireeís financial security. Where would Michiganís DC State retirees be now, without the forward thinking and enthusiastic State employees that made Deferred Compensation into a reality?

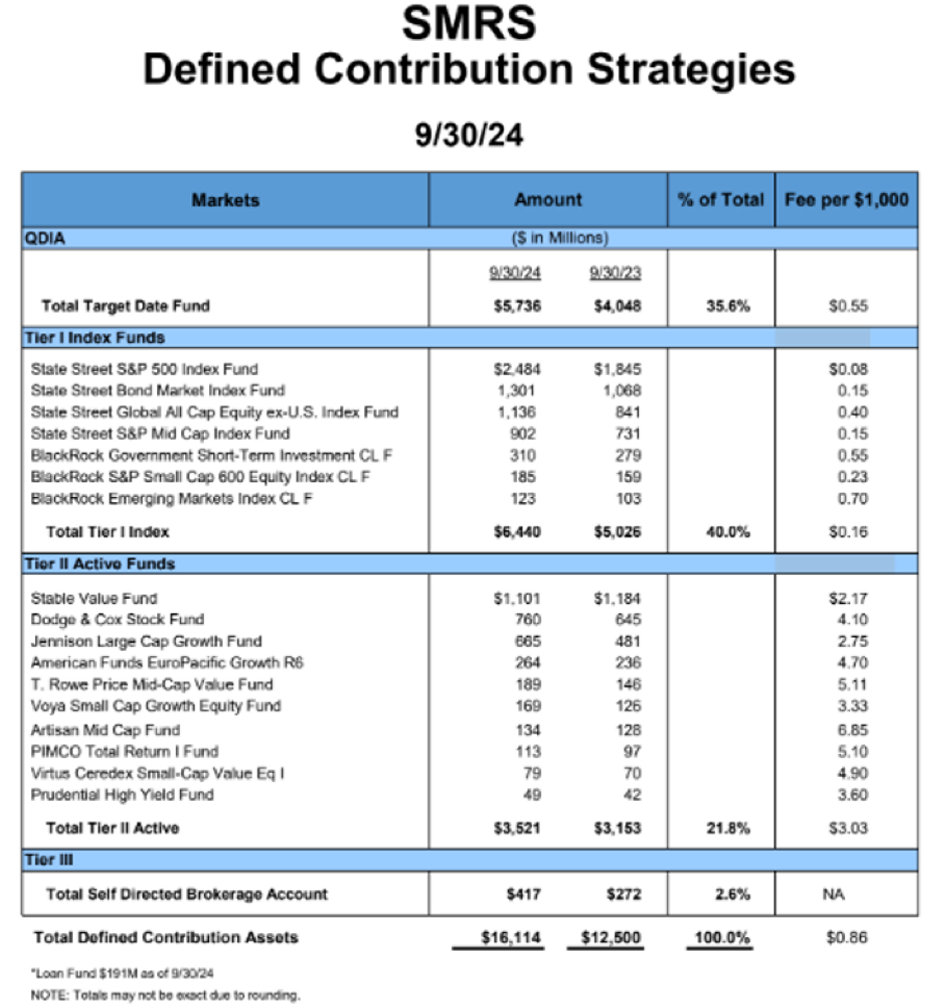

Defined Contribution Strategies — The “SMRS Defined Contribution Strategies” chart provides the dollar amount and change in fund balance by the tiers of investments offered. The State of Michigan Retirement Systems (SMRS) Total DC assets have grown to $16,114 million in fiscal 2024, based on data ending on 9/30/2024. This is compared to $12,500 million in fiscal 2023. The fund balance total differs from the previous table as the data is from fiscal years vs. calendar years.

DC Investment Options — Within the 2024 annual total for the DC program, Targeted Date Funds (TDF) make up nearly 35.6 percent of the assets. TDFs are used to save for retirement, with investors selecting a target date fund based on their target retirement date. As investors get closer to their retirement time and start using their savings for income, they need to protect more of their money from losses. They become more conservative by changing the mix of assets. TDF is the default tier assigned if the employee doesnít specify a higher tier risk level. The “SMRS Defined Contribution Strategies” chart shows that these TDFs come with low fees. In addition, Tier I Index Funds comprise 40 percent. Index funds typically charge little due to their passive management. Tier II Active Funds make up 21.8 percent, and Tier III, Self Directed Brokerage Accounts, represented 2.6 percent.

Editor’s note: Joanne Bump serves as feature columnist for “Retirement Matters.” Column content is time sensitive and is based on information as of 2/9/25. Joanne can be contacted by e-mail at joannebump@gmail.com.

Return to top of page