Retirement Matters

August 2023

State of Michigan Retirement Board (SMRB) — In May, the board met to present findings from the annual actuarial reports on the health benefits for the State Employee Retirement System (SERS). This report was prepared by Gabriel, Roeder, Smith & Company (GRS) and was based on September 30, 2022, data, the latest available. It’s based on an actuarial valuation or an analysis performed by an actuary comparing the health benefit assets and liabilities. The latest valuation determined the actuarial computed employer contribution for fiscal year 2025. It also measures the progress, in growth or decline, of the retiree health plan. Actuarial valuations assess the long-term sustainability of health benefits and help plan sponsors to make decisions.

Pre-Funding Health Benefits — SERS health benefits have been paid for either by cash or by pre-funding. Historically, they were paid by cash rather than pre-funded over the last decade. The cash approach left health benefits to the policy whims of changing administrations. Health benefits could be subjected to reductions when balancing the budget during recessions. Pre-funding assured that health benefits would likely be there when needed. Retirees’ financial security and quality of health care is intrinsically linked to fully funding health benefits.

This employer-subsidized health insurance coverage is the primary health plan until the retiree reaches age 65, when it becomes secondary to Medicare, or Medicare Advantage. Unlike State pensions, health benefits have not been pre-funded for a long time. Defined Benefit retirees have depended on these health benefits for decades on a pay as you go basis. While pre-funding contribution rates began to be calculated in 1999, actual contributions only began recently.

Pre-funding of State employee health benefits started in fiscal year (FY) 2013 after Governor Snyder signed Public Act 64 of 2012. Before FY 2012, State retiree benefits were paid on a cash basis each year without assets in reserve. Under a cash basis, the unfunded accrued liability for these benefits was estimated at $15.2 billion based on the analysis at the time. Due to Michigan’s sound financial practices, retirees are now in better shape, compared to most nationwide state sponsored plans that do not pre-fund health benefits.

Review Costs — Highly trained actuaries are essential to the health insurance industry as they evaluate the risk of future events. They don’t have a crystal ball to see the future. Even so, they analyze the financial cost of uncertainty and risk with mathematics, statistics, and financial theories. The actuaries’ assist policy makers to develop options that reduce the cost of health benefits.

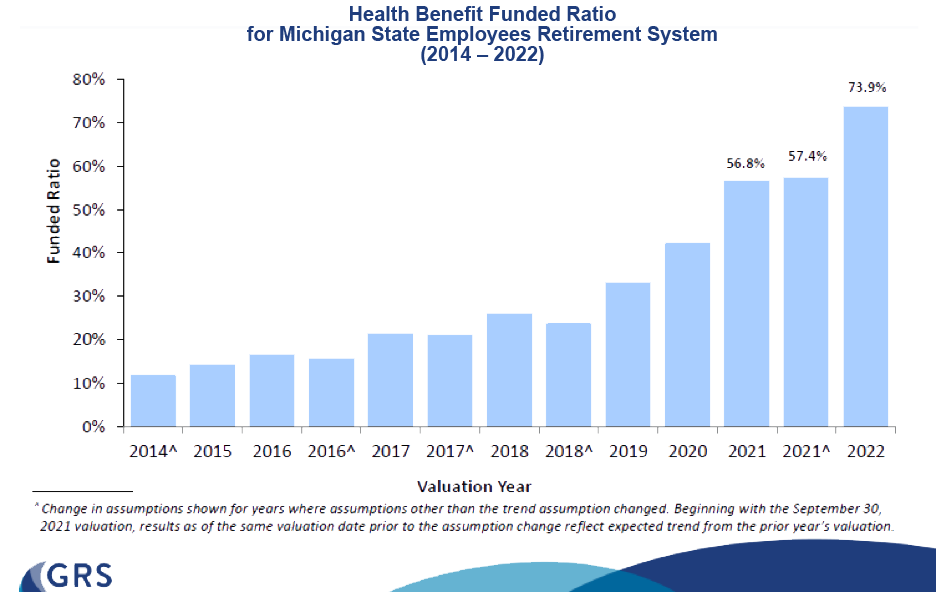

Health Benefits Paid Up? — The funded ratio looks at how much of our SERS retiree benefits are paid up. It measures the ratio of dollars in the fund compared to the value of promised lifetime income benefits. A funded ratio below 100 percent, like Michigan’s, means that the plan has not saved enough.

Michigan’s Ahead — Most state governments provide access to health benefits for qualifying defined benefit retired employees. According to the Equable Institute, Michigan ranks high among the states in pre-funding of retiree health benefits.

Government Works — See the chart illustrating the annual funded ratio as one measure of progress toward paying down the unfunded obligation. The SERS’ funded ratio has moved along a fairly upward trend for a nine-year period from just over 10 percent in 2014 to 73.9 percent in 2022. This is a phenomenal success. It’s a stunning example of how government has worked for you. Help assure that this remains a high priority into the future by lifting your voice in support of officials that stay on task and stick to the funding schedule. See the report on the Office of Retirement Services website.

Higher Cost — The 2022 GRS report concludes that state health plan costs are likely to rise as more defined benefit members retire and collect health benefits, and when health care inflation grows faster than regular inflation. Further, the report points to circumstances that would increase health benefit costs in the future, many of which have already emerged and have been reported on in past SERA-Nade’s including:

- Funding cuts or cost shifts for Medicare funding.

- Unanticipated new retiree benefit recipients which could result from benefit cutbacks of other employers.

- Higher than assumed inflation for medical or prescription drug costs. The actual future contributions will depend on future per capita health inflation or cost increases.

- Lower than expected investment plan returns, having a larger impact for well-funded plans.

Are Medicare Cuts Essential? — The 2023 Medicare Trustees Report didn’t mention any dire news about Medicare financing. Yes, Medicare costs are high and growing. But the projected Medicare deficit is usually framed against the backdrop of providing overly generous benefits, implying that the answer is to cut benefits. In reality, Medicare coverage is already less comprehensive than most private sector health insurance plans. For instance, Medicare covers only limited mental health benefits. Under traditional Medicare benefits, seniors are not covered for dental, eyeglasses, or hearing aids. In addition, it does not have an upper-limit on cost-sharing requirements for hospital stays, skilled nursing facility care, or physician charges. Given this, seniors with long and expensive medical conditions are spending down their assets for uncovered out-of-pocket costs.

Seniors are hoping that policy makers will rise to the challenge of holding down cost for the benefits that are already provided as well as create a cushion for benefit enhancements. In reality, Medicare’s costs are high because it works within a high-cost market. Costs for hospital and physician services are rising faster than the U. S. Gross Domestic Product. The risk for higher health benefit costs isn’t set in stone as policy makers have the power to change future policies. The answer is to get U. S. health care spending under control in order to lower Medicare costs.

Editor’s note: Joanne Bump serves as feature columnist for “Retirement Matters.” Column content is time sensitive and is based on information as of 5/7/23. Joanne can be contacted by e-mail at joannebump@gmail.com.

Return to top of page