Retirement Matters

May 2023

Assisted Living Evictions — During the early years of retirement, most middle-income seniors don’t assume they will ever need Medicaid. However, Medicaid (health care for those with low incomes) is the primary payer of long-term care (LTC) services in the United States. Nearly 4.4 million Americans have LTC that is paid for by Medicaid. Seniors need to pay attention to a growing trend. According to a Washington Post report, residents of Assisted Living Facilities (ALFs) are being evicted when transferring their private health care coverage to Medicaid. Seniors are drawn to ALFs, rather than nursing homes, because they are home-like with greater living space, a private room, and modern facilities. ALF residents spend down their savings as they pay for these more expensive LTC arrangements.

ALFs Back Out — These evictions take an emotional toll on residents who enter ALFs paying full private rates out of pocket with the understanding that once their nest egg has been spent down, they can remain in the facility on Medicaid. These arrangements are commonly presented by marketing staff, say elder-law attorneys. Yet ALFs can fail to fulfill these promises, citing a limit on the number of beds that are Medicaid eligible. This may be found in the fine print of resident agreements or not mentioned at all. If the ALF is sold or they just change their mind, they can back out of the Medicaid contract completely. When this happens, the resident has already used up their nest egg, with no legal recourse available.

No Eviction Protection — While federal law protects Medicaid recipients from eviction in nursing homes, ALF residents are not protected, resulting in less options later on. The federal government doesn’t regulate ALFs or keep data on the number of evictions. What we know is that the state government ombudsmen, or officials appointed to investigate individuals’ complaints for LTC, received 3,265 complaints on evictions from ALFs in 2020. The reasons for these evictions are not recorded, but when state ombudsmen were interviewed, they thought that the residents’ needs had become too great to be cared for at the ALF. Advocates, family members, and nonprofits managing the Medicaid contract assert that the incentive is financial as Medicaid rates are too low to care for the residents’ needs compared to the private payment rates.

Transfer Trauma — In 2020, about 18 percent of 818,000 residents in U.S. ALFs were paid by Medicaid. Evictions are very traumatic for residents and their families. Residents may have lived in these ALFs for several years, and made friends with the staff and other residents. They may feel betrayed after having received reassurances from facility owners that they could stay on at the Medicaid rate, after depleting their assets. Moving elderly people from a familiar home may result in “transfer trauma” that can speed up their decline.

Medicaid Disenrollment — The federal government preserved the Medicaid safety-net health coverage for the past three years during the pandemic. About 84 million American people are covered by Medicaid which has increased by 20 million people since January 2020. This temporary guarantee is now ending. This change will impact people who make too much to qualify for Medicaid, but not enough to reach the income needed to get federal subsidies to afford health plans offered on the Affordable Care Act (ACA) Marketplace. Advocates are saying that this is the biggest health insurance disruption since the ACA was enacted a decade ago.

Qualification Review — Federal and state governments jointly finance Medicaid, but state governments determine whether their residents qualify for Medicaid. States are reviewing whether people now continue to qualify for Medicaid, and enrollees must provide proof that they deserve coverage. Based on this review, states will begin to remove people from Medicaid between this May and July. The Biden administration is encouraging states to avoid a skyrocketing of the nation’s uninsured.

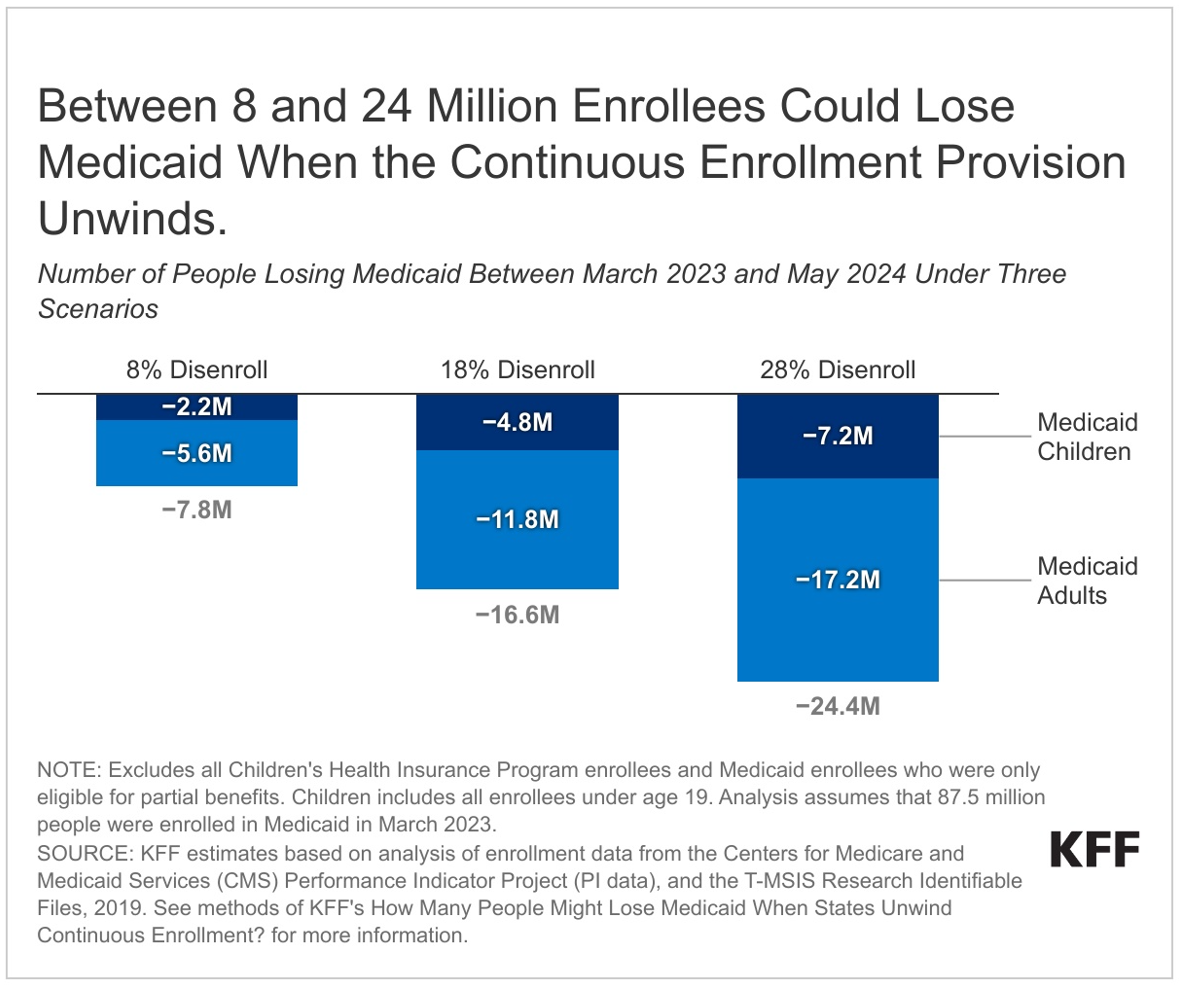

Coverage Lost — The number of Medicaid beneficiaries impacted will vary depending on the states’ approach, and engagement in outreach and assistance to continue coverage. See the Kaiser Family Foundation (KFF) chart with the three scenarios for the people losing coverage. The disenrollment rate ranges from 8 percent to 28 percent, with the midpoint rate of 18 percent. Nationwide, between 8 and 24 million could lose health coverage. In Michigan, Kaiser estimates a total loss of Medicaid coverage of 591,000 people, made up of 455,000 Medicaid adults and 135,700 Medicaid children, assuming an 18 percent loss scenario. Reach out to seniors you know who rely on Medicaid and encourage them to take actions to maintain their health care coverage. This includes updating their contract information, checking the mail, and filling out forms. If they are disenrolled, make other plans. Do they qualify for Medicare or Marketplace coverage? Also, find out the new plan’s enrollment period in advance to apply by the deadline.

LTC Executive Order — President Biden signed Executive Order 14095 on April 18, 2023. Part of the order includes expansion of affordable, high-quality care and help to support care workers and family caregivers providing long-term health care. This will also enhance the services available for Americans struggling to afford the care they need and obtain home and community-based services instead of being placed on a waiting list. In addition, President Biden’s 2024 Budget adds $150 billion over the next decade for Medicaid home care services.

Energy Rate Hike — Attorney General (AG) Nessel reduced the rate increase request filed by Consumers Energy with the Public Service Commission (PSC), which would have cost consumers $212 million a year. This utility serves 6.7 million customers in 68 Michigan counties, making it Michigan’s largest gas and electric utility. AG Nessel said that Michigan residents are facing enormous pressure as their heating bills consume more and more of their household income. AG Nessel said her proposal would cut the ratepayers’ cost to about $52 million. She also asked the PSC to reject a request for a $2 monthly surcharge on gas bills. Consumers Energy responded that the rate hike was needed to pay for upgrades to its natural gas delivery system.

Editor’s note: Joanne Bump serves as feature columnist for “Retirement Matters.” Column content is time sensitive and is based on information as of 5/7/23. Joanne can be contacted by e-mail at joannebump@gmail.com.

Return to top of page