Retirement Matters

May 2022

Hold on to your pocket book as challenges are coming your way. Read: key plans to sunset Social Security and Medicare, Medicare Advantage benefit denials, and rising cost.

Sunset Benefits — U.S. Senator Scott (R-FL) is calling for all federal legislation to end in five years if Congress does not reauthorize them. This would include benefits like Social Security (SS) and Medicare. This legislation could greatly harm your retirement savings and medical care for you and your loved ones. But wait a minute, didnít you and your employer pay for these benefits with payroll taxes all your working life?

The sunset would also include ending Medicaid, or health care coverage to those with low incomes. This isnít funded by your payroll taxes, but itís important to seniors as it finances long-term care for those who run out of money after a long illness. Those supporting the sunset say Congress can always reauthorize these benefits if there is legislative support. But itís not that easy. We know of legislation, with overwhelming popular support, that canít get the approval of this divided Congress. The cost to seniors for this sunset is that it creates uncertainty over their financial security.

The justification for reducing or ending SS benefits is that the Social Security Trust Fund could run out of funds in the 2030s. But that doesnít have to happen if it's managed properly in advance. Action could be taken on the many legislative proposals that would ensure the Trust Fundís solvency.

Medicare Advantage (MA) — State employee retirees 65 years old and over receive a MA health insurance plan as the alternative to traditional Medicare. Private health plans, like Blue Cross Blue Shield MA, receive payments to provide all Medicare-covered services for Medicare Part A and Part B. Michigan is among the 24 states, with at least 40 percent of Medicare enrollees covered by MA.

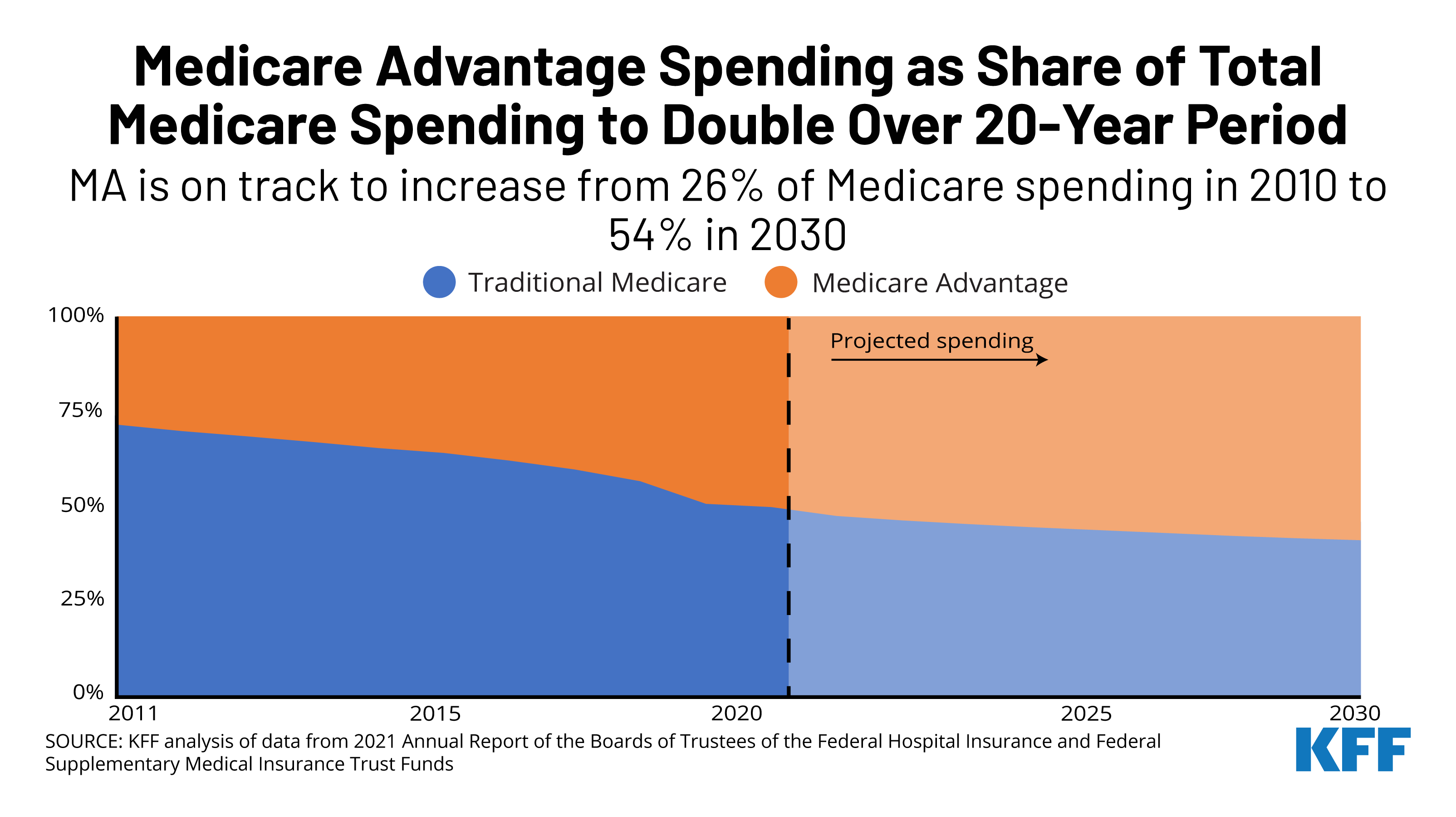

The Kaiser Family Foundation (KFF) has reviewed MA plans nationwide, but their findings arenít specific to your State employees plan. The report shows that funds are being diverted toward profits to private health insurance plans. In addition, Medicare is on track to be privatized as the percentage of enrollees in the MA plan continues to grow. Nationwide, enrollment in MA has doubled twice over the last ten years. Further, MA spending has increased steadily as their payment policies have shifted from saving money to expanding benefits. See the figure illustrating how MA spending, as a share of the total Medicare spending, is projected to double over a 20-year period, ending in 2030.

MA Paid More — MA plans have grown in popularity as TV ads feature famous personalities promoting their benefits. But it isnít necessarily better for seniors in the long run. On the up side, plans have offered extra benefits like gym memberships and attractive lower premiums. On the down side, MA plans include benefits that may change every year, restrictions on network providers, erroneous network listings, and the wrongly denied claims and pre-authorizations as discussed below. Finally, MA plans will cost more in future premiums than regular Medicare. From 2009 to 2021, MA plans were paid $140 billion more than if the patient had remained in traditional Medicare. The question is whether we can afford it in the future.

MA Denies Claims — In late April, the Inspector Generalís Office at the Department of Health and Human Services (HHS) was on the job. It reported its findings that MA plans are denying or delaying legitimate claims and refusing to authorize reasonable medical procedures. The Inspector General estimates that 13 percent of claims that MA insurers denied should have been covered. Further, MA plans also incorrectly rejected nearly 85,000 prior authorizations as the documentation necessary to support the payment were disregarded. Many of these denials were for imaging services like magnetic resonance imaging (MRI) and computerized tomography (CT) scans. They also denied requests to send patients to a nursing home, after a hospital stay, when their doctor decided that they needed more health care than was available at home. For more on the report, search ďMedicare Advantage Denials of Care.Ē

Oversight Needed — Denying legitimate claims means greater profits for private health insurance companies with less money left to pay for retireesí quality health care. It also affects the affordability and solvency of Medicare. In addition to the shift in market share to MA plans, recent efforts include increasing the role of private, for-profit companies in traditional Medicare. The long-term finances of Medicare are at risk as MA enrollment continues to grow and MA plans are overpaid. New legislation has been introduced in both the federal House and Senate called Improving Seniorsí Timely Access to Care Act. It would help to streamline and standardize how MA plans apply prior authorization and expand oversight and transparency.

House Aging Committee —With so many pocket book issues impacting seniors, itís time to bring back the federal House Select Committee on Aging. This committee was disbanded back in 1992 to reduce costs and streamline the legislative process. But, the federal Senate Special Committee on Aging continued on. While other committees oversee some aging issues, no other House legislative committee focuses on the priorities of older Americans.

In-Person Help — Social Security Administration (SSA) offices opened again in April after being closed for most of the pandemic. Before COVID hit, these field offices were already struggling to provide the supportive customer service needed as seniors age because they have been chronically underfunded by the U.S. Congress. SERA members have reported back about their recent visits that waiting lines were shorter than they expected. The SSA encourages us to visit them online, but many, who find using computers challenging, are more comfortable going to the office for help. You can file claims, get a copy of your SS card, and ask questions face-to-face with an expert. For some, there is no replacement for in-person service. To find a SS office in your area, search Social Security Office Locator.

Editor’s note: Joanne Bump serves as feature columnist for “Retirement Matters.” Column content is time sensitive and is based on information as of 5/8/2022. Joanne can be contacted by e-mail at joannebump@gmail.com.

Return to top of page