Pension Matters

State Employees Retirement Fund

Most Recent Market Value | Michigan Treasury Bureau of Investments

June 2016

Having been on vacation during the past two weeks of May in beautiful Monterey, CA., this month’s Pension Matters will be short and sweet. Be back in full swing next month. Don’t forget to check out the Lansing SERA Facebook page.

P.S. Thanks to “Bob” for the kind words about Retirement Matters.

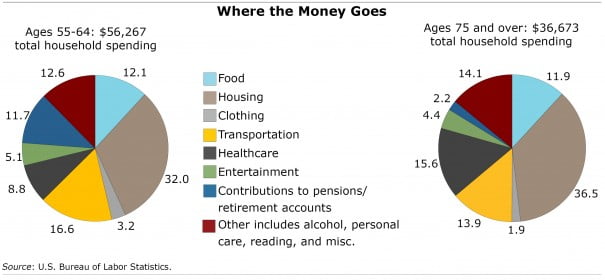

How and On What Seniors Spend their Money

Read the full article at www.squaredawayblog.bc.edu

Saving Pensions

The U.S. Treasury Department is expected to rule on a “rescue plan” application it received last September by the Central States Pension Fund (CSPF) that would cut benefits for 270,000 retirees in the U.S. to maintain its solvency. The Illinois-based Central States fund represents 24,000 retirees in Michigan alone.

The Pension Fund Integrity Act which would cut pay and prevent raises and bonuses for top pension fund executives if retirees’ benefits are cut, is being championed by Michigan Democrats Debbie Stabenow and Gary Peters. This legislation is in response to The Central States Pension Fund submission of an application to the U.S. Department of Treasury that would drastically cut pension benefits for roughly 270,000 retirees across the country. www.aminewswire.com

Who is Middle Class?

“About half of American adults lived in middle-income households in 2014,” according to a new Pew Research Center analysis of government data. “ In percentage terms, 51% of adults lived in middle-income households, 29% in lower-income households and 20% in upper-income households.” Check out your status on their web page at www.pewresearch.org.

In Michigan the greatest loss in middle income households has been in the Detroit/Warren/Dearborn and Jackson areas.

Do They Deserve Their Pension?

Thirteen former and current Detroit Public School principals charged with a felony in a $2.7 million kickback and bribery scheme at the district remain eligible for their state pension according to a Detroit Free Press article.

Caleb Buhs, a spokesman with the state Department of Technology, Management and Budget, which is in charge of the Office of Retirement Services and Michigan Public Employees Retirement System, said “state statutory language says that if an employee is found in violation of the public trust, a court can order a revocation of his or her public pension.” However, according to the News, no court order has been requested. Read the entire article at www.detroitnews.com.

Detroit Pension Fund - FYI

Wayne County commissioners approved shifting more than $14 million to the county’s underfunded pension system , but the move did not come without controversy. Read more at www.freep.com

Upcoming Meetings You Might be Interested In

Investment Advisory Committee (Bureau of Investment) next meeting is June 16th. The Quarterly reports are placed on Bureau of Investment web site shortly after each meeting.

Retirement Board’s next meeting is August 18th.

More information and data can be found on the Bureau of Investment and Office of Retirement Services websites.

Quotable But Scary

“48% of Americans saving for retirement are pretty sure they have no idea what they’re doing by Myles Udland: a new report by the Federal Reserve finds that almost half of Americans saving for retirement in 401(k) plans are not confident that they are making good investment decisions. A lack of professional investment management is one of the many flaws of 401(k)s and the poor investment decisions made by many individuals contributes to their lack of retirement security.”

Editor’s note: June Morse may be contacted at jmorse10@comcast.net or 517-886-9323.

Return to top of page